Portugal 2025: A Smaller Harvest but an Opportunity for Quality Repositioning

Portugal faces a significant drop in its 2025 wine production. However, this downturn could become an opportunity to refocus on quality and authenticity.

Portugal 2025: A Smaller Harvest, But Wine Tourism and Native Grapes Offer Hope

Portugal heads into the 2025 harvest with tempered expectations. National output is forecast at just 6.2 million hectoliters, down about 11% compared with the five-year average. The decline stems from unstable weather, rising disease pressure in the vineyards, and a slowdown in international demand.

Regional contrasts

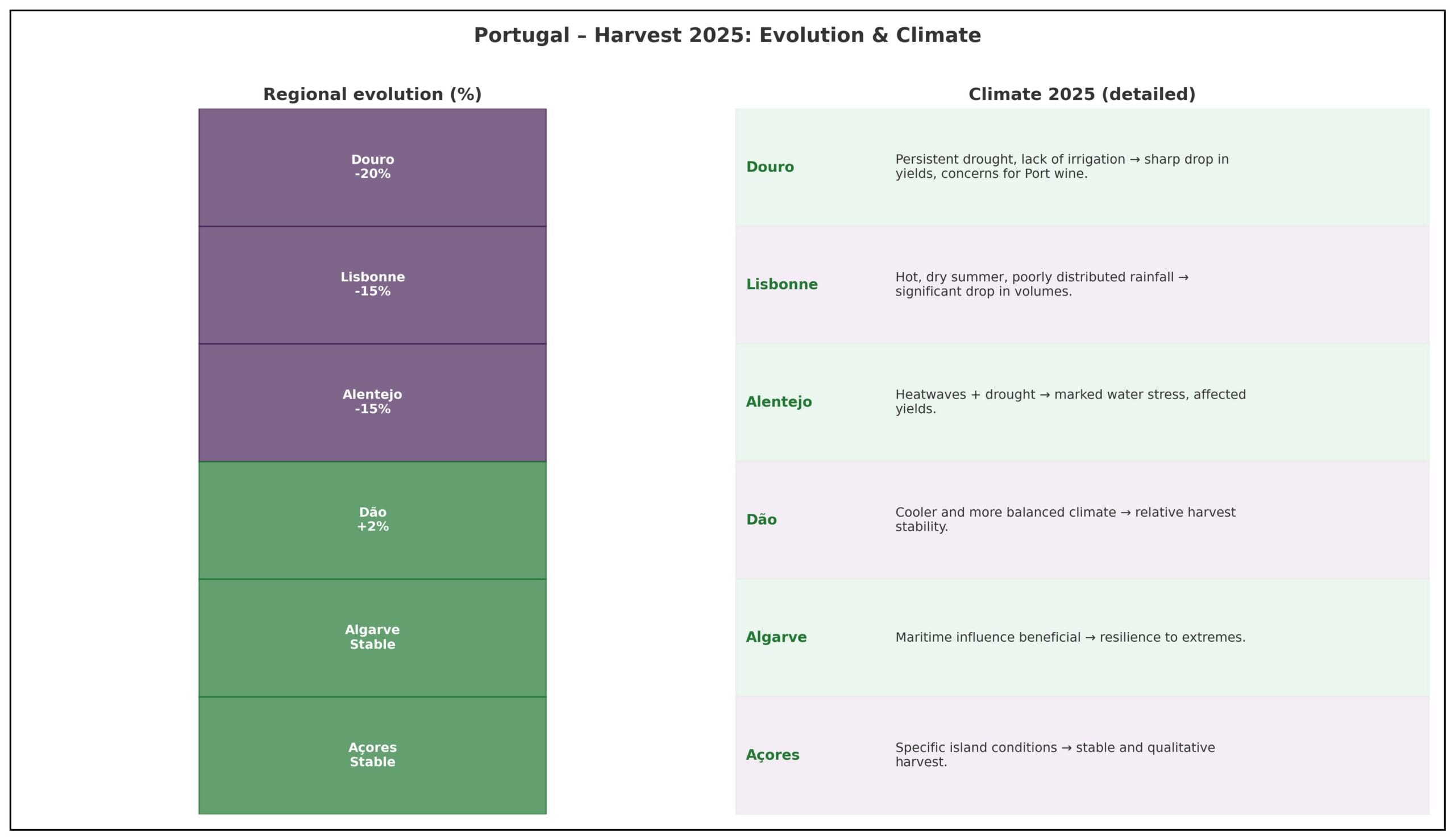

Some of the country’s flagship regions are among the hardest hit:

- The Douro Valley, down around 20%, where drought and limited irrigation have taken a heavy toll.

- Lisbon and Alentejo, each expected to fall by roughly 15%.

Overall, national volumes could shrink by about 679,000 hectoliters compared with 2024. Yet not all areas are struggling: cooler zones such as Dão, as well as peripheral vineyards in the Algarve and the Azores, are showing relative stability, with healthier fruit and more balanced profiles.

Climate and disease challenges

Extreme swings in weather — sudden downpours followed by heatwaves — have fueled outbreaks of downy and powdery mildew. In the Douro, water shortages are so severe that some growers fear parts of their crop may go unsold, especially for Port wine, where demand is softening.

Prices, stocks, and market outlets

Bulk wine prices are expected to remain close to late-2024 levels, limiting room for producers to raise margins. Stocks, already under strain, further tighten their flexibility. Still, Portugal retains strong assets: its wealth of native grape varieties, the diversity of its terroirs, and the country’s growing appeal as a wine tourism destination.

Wine lovers increasingly seek out authenticity, and Portugal is delivering: family-run estates, immersive vineyard visits, and local tasting experiences continue to attract international visitors. Wine tourism has become a vital lever, not only adding value but also forging stronger bonds between consumers and the regions they discover.